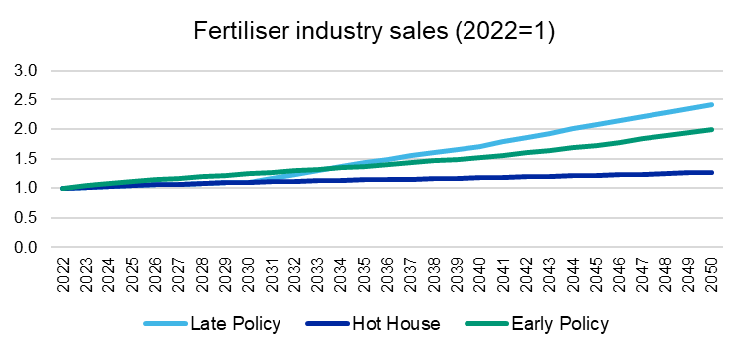

Moody’s helps risk managers with their portfolio compliance guidelines, net-zero targets, and identify adaptation and resilience opportunities including those specific to the material physical risks identified through our modeling tools.

Climate change regulation and disclosure requirements are rapidly evolving and region-specific. For example, in Europe, executed EU banking regulations and ECB expectations are creating new challenges and opportunities specific to lending and risk management. In the US, while the policy landscape is less mature, preliminary exercises such as the Federal Reserve Board’s Climate Risk Exposure Stress Testing set the stage for future regulatory mandates. Under these increasing worldwide regulatory and market pressures, forward-thinking financial institutions are looking to incorporate climate risk into their workflows with consistency.