Climate Risk is Business Risk

Why Moody's

Rigorous, Reliable, and Transparent Foundation to Integrate Climate Risk into your Workflows

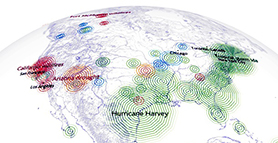

Navigate an Uncertain Landscape of Increasingly Interconnected Risks

Explore Moody's Climate and ESG Capabilities

Integrated risk insights built on the foundation of Moody’s financial intelligence bolstered with climate, ESG, and sustainable finance IP. Data, analytics, and technology to guide better decisions

Research & Insights

Curated Research & Insights on critical dimensions of climate risk covering financial quantification, credit impacts, macroeconomic outlooks, and sector-specific implications

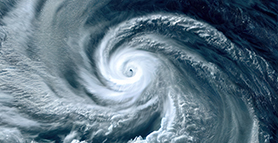

Adapting to Hurricane Risk

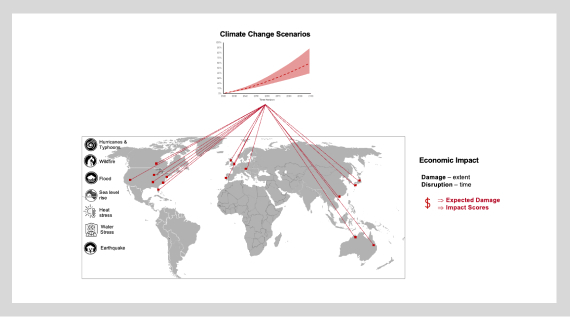

Discover how Moody’s is helping insurers and real asset investors perform cost-benefit analyses on property-level hurricane adaptation investments, by modeling physical risks in the built environment and enabling stakeholders to measure the financial impact of hurricane risks now and in the future.

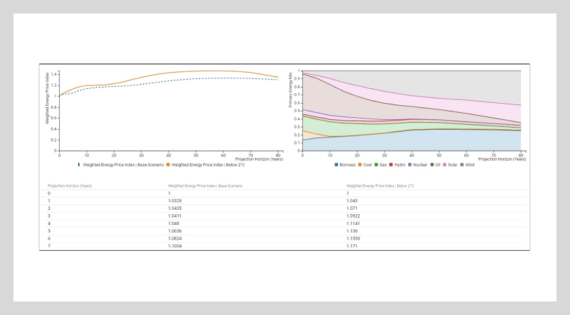

Quantifying Financial Impact of Climate Risk with Moody’s Climate on Demand

Following increases in climate-driven losses, asset managers and owners urgently need to answer this question: How can I accurately assess the impact of climate and climate change on my asset portfolio to inform strategies that can help reduce my climate risk exposure?

Powering a Greener Future in Asia Pacific

Bringing our recent research on APAC’s energy transition to its close, we will host a webinar looking at what energy transition means for energy security, what the main risks and opportunities are in the pursuit of net zero, which countries and sectors are most affected, and more.

China-National ETS Is Credit Negative for Coal Power Generators, but the Impact Will Be Gradual

The last in our series of reports on APAC’s energy transition takes a detailed look at China’s emissions trading system – the world’s largest – and its impact on the country’s coal power sector.

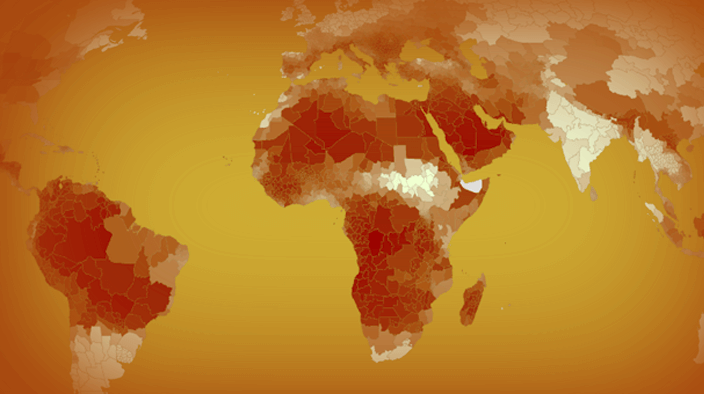

Startups and Nonprofits Race to Unlock Africa’s Agriculture Potential as Millions Face Food Crisis and Droughts

Extreme temperatures, dryness and drought, exacerbated by climate change, are threatening Africa’s food supply chain, food production and development. Numerous actors — from governments and big business to global humanitarian organizations and African startups — are responding to the continent’s food challenges.

Asia-Pacific: Credit Impact of Energy Storage Advances to be Felt Increasingly by Power Companies

The first in a series of reports on the opportunities and challenges associated with APAC’s energy transition looks at the need for technological advancement in energy storage solutions, which currently are not economically viable at a large scale.

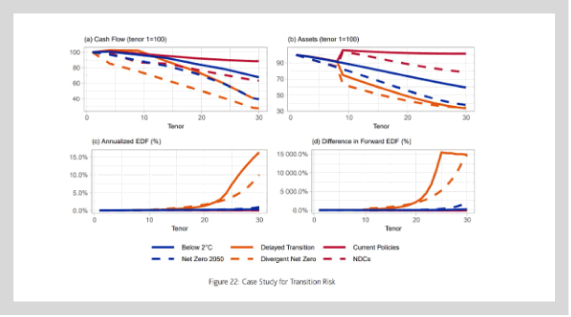

Effective Decarbonization Plans Mitigate Transition Risk, but Limited Disclosures Inhibit Assessment

The prevalence and ambition of decarbonization targets are lowest among companies most exposed to transition risk. Given the increasing market and regulatory pressures, a lack of clarity on plans is likely to lead to rising credit risk for those most exposed. Comparing plans is difficult because the granularity of disclosures varies widely.

Talk to a Moody’s climate risk expert today.

Explore how Moody’s on Climate delivers insight on risk and opportunity with robust and reliable data and analytics, and transparent methodologies you can trust.

Let us share how our Moody’s on Climate solutions are designed to complement your existing workflows to deliver the insight you need. Our DNA is financial intelligence and our investments have amplified our offerings with data, modeling, and IP for financial quantification of climate risk to help you make better, faster decisions.