The risks associated with supply chain disruption from weather and climate-related events have been highlighted with regularity across the globe over recent years.

Here are just four of many examples:

Any future changes in climate and weather patterns could potentially increase the frequency, intensity, and severity of events, and in turn, increase these risks and their impact on communities and costs to businesses.

In terms of supply chain disruption, the recent water scarcity events in Taiwan are a very relevant example.

As more and more devices rely on a range of semiconductors to function, the supply of semiconductors for the modern global economy has become critical.

Any break in supply also results in other production lines, such as cars and computers, grinding to a halt.

Therefore, the importance of the semiconductor supply chain, from the manufacturing plant to distribution through to the end user, cannot be underestimated.

Taiwan’s Leading Role in the Advanced Semiconductor Industry

It is estimated that 75 percent of the world’s semiconductor manufacturing capacity is concentrated in East Asia and China, with Taiwan and South Korea producing the majority of the world’s semiconductors.

Ninety-two percent of the most advanced (below 10 nanometers) semiconductor manufacturing capacity is based in Taiwan.

With such a geographically concentrated semiconductor manufacturing industry, concerns are growing about the region’s exposure to climate change and the knock-on effects on supply chains around the world.

Building semiconductor manufacturing plants is a capital-intensive, specialist endeavor. Plants with the most advanced chip-making technology and equipment regularly cost tens of billions of dollars, and plants cannot easily be brought back online or replicated if a disaster strikes.

In terms of rainfall, Taiwan is technically one of the wettest places on Earth due to typhoon-driven rainfall. With an average of up to four typhoons, the country typically receives 2,500 millimeters (98 inches) of rainfall per year.

However, during the 2020-21 Pacific typhoon season, Taiwan did not experience a single landfalling typhoon.

This exposed the country’s vulnerability to drought, and Taiwan’s reliance on the regularity of typhoons for the plentiful supply of freshwater, to meet the needs of its manufacturing and agriculture sectors.

Limited reservoir capacity due to its hilly terrain also meant that shocks to a geographically concentrated supply chain can be amplified by the impacts of climate perils, particularly if multiple plants are impacted by the same severe climate event.

Moody’s Analytics research utilizing Orbis, a powerful data resource on private companies, combined with our recently updated global climate risk modeling platform Climate on Demand Pro, is helping deliver new insights into the climate risks facing companies, sectors, and individual facilities around the world.

For our Taiwan example, our research shows that across semiconductor facilities located in Taiwan, their costs related to climate risks could rise substantially over the next 20-30 years.

By 2050, the costs of flooding are expected to rise by around 30 percent, from water stress by 35 percent, sea level rise by 60 percent, and heat stress by 150 percent by 2050 under a moderate climate change scenario.

An extreme climate change scenario would accelerate water stress by four to five times.

While Taiwan continues to be the global leader in high-value semiconductor manufacturing, other Asia-Pacific countries, particularly South Korea, Japan, and China, have their own semiconductor industry development strategies.

For all these countries, our analysis shows that the impact of water stress is expected to increase, particularly in South Korea which could see an impact of over 75 percent by 2050 (using a moderate scenario) on costs and reduced production without additional risk reduction features.

South Korea’s lengthy coastline and its low-lying coastal areas are also very vulnerable to sea level rise and could see increased costs to industrial facilities of over 70 percent on average by mid-century.

With India also starting to initiate policies favoring greater self-sufficiency in semiconductors, it also faces an overall doubling in the risk from flooding by mid-century.

Individual locations will see greater or lesser impacts than these; Moody’s Analytics location level climate risk analytics can help inform when planning the siting of these facilities and the cost/benefits of risk reduction measures.

Reviewing Supply Chains Post-COVID

Since the COVID-19 pandemic, many countries in the West are now reviewing their supply-chain vulnerabilities, while also considering how to stimulate their own manufacturing capability combined with investment in green technology.

For example, the United States government has launched financial incentives for manufacturers of electric vehicles, green-energy infrastructure – and semiconductor chips.

To increase manufacturing capacity in the U.S., billions of dollars are being invested to diversify supply, with US$39 billion dollars allocated for new or expanded fabrication plants in the U.S. as a part of the CHiPS Act.

While there are many factors to consider when assessing the siting of a new manufacturing plant, Moody’s now has the data and analytics to include the potential impacts and increased costs associated with climate change in those location selection decisions.

Given that a manufacturing plant will be operational for decades into the future, taking potential future impacts of climate change into account, such as how water supply and the effects of heat stress on operations may change, along with potential damage and disruption from flooding and storms, makes business sense.

New U.S. semiconductor manufacturing development plans have recently been announced in states including Arizona, New York, Ohio, Texas, and Utah.

Our analysis shows that, for example, New York ranks within the top ten U.S. states where water stress is expected to increase the greatest on a relative basis over the next 50 years using a moderate (RCP 4.5) scenario.

And while states such as Arizona, Utah, and Texas are already highly prone to water stress, large relative increases in other climate risks such as flooding could have material impacts due to under-preparedness, even if on an absolute basis the risk in 2050 is still relatively low compared to other regions.

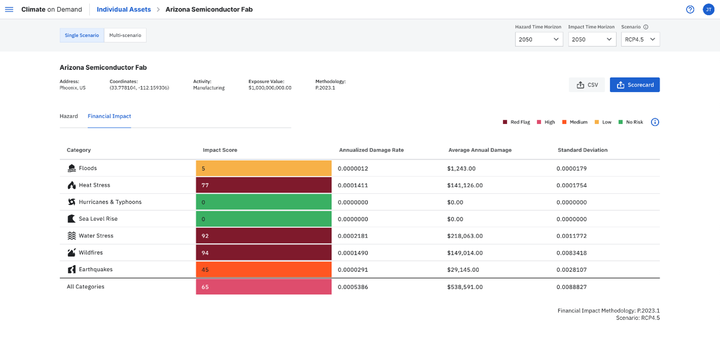

For the multi-billion dollar fabrication plant being developed north of Phoenix, Arizona, potential climate change impacts are large, led by water stress and heat stress.

Under a moderate (RCP4.5) climate change scenario by mid-century, for a hypothetical US$1 billion of exposure, several hundred thousand dollars of damage and business disruption are projected to occur for heat stress, water stress, and wildfires each year on average.

Costs from heat stress are projected to more than double compared to today, with extreme heat expected to affect labor productivity and energy costs.

Since its release earlier in June this year, the Climate on Demand Pro solution is now being used by multiple clients to drill into location-level analysis of the impact of climate change on expected damage, business interruption, and costs from multiple climate perils under different climate change scenarios and time-horizons.

One of our customer’s key use cases for our unique climate risk analytics customers is to plan locations for new manufacturing facilities.

To learn more about Moody’s Climate on Demand and analyses on key trends shaping global climate change risk assessment, please visit Moody’s Climate on Demand and talk to an expert today.