In a world where it feels as if the financial markets are ruled by short-termism and a focus on quarterly corporate reporting, in contrast, asset owners stand out by managing their portfolios on time horizons measured in decades or even longer.

With trillions of dollars in assets under management and a goal of long-term well-being for their beneficiaries and other stakeholders, risk management practices for asset owners must be robust.

This robustness includes consideration of factors beyond traditional financial metrics. While a long time horizon allows asset owners to withstand short-term volatility, their portfolios may be exposed to higher levels of other risks, including those posed by a changing climate, which is not necessarily accounted for in asset prices.

Additionally, regulatory actions such as the European Union Sustainable Finance Action Plan, growing global support for the Task Force on Climate-related Financial Disclosures (TCFD), and groups like the Network for Greening the Financial System, whose members include 42 central banks and supervisors, are pushing investors of all stripes to take physical climate risks into account, warning of dire systemic consequences if climate risks continue to go unpriced.

Translating Climate Models and Data Into Actionable Intelligence

With climate risk moving from the fringes of finance to center stage, the challenge is to translate climate models and climate data into actionable intelligence for financial decision-making.

Measuring asset-level climate risk is a highly complex task that has challenged the risk modeling community, resulting in a race to produce meaningful metrics across a variety of industries.

The scientific community is largely landing on a consensus that to measure climate change impacts at the resolution required to make financial decisions, both general circulation models (GCMs) and catastrophe (cat) risk models are needed.

GCMs are instrumental in modeling large-scale, long-term, global modes of variability and trends in atmospheric and ocean circulation systems, but they cannot be run at high enough resolutions to capture all meaningful processes at regional and local levels.

Catastrophe risk models, on the other hand, are used to model near-term outcomes in extreme weather-related events and have been used in the insurance industry (one of the most highly regulated financial services industries) for over three decades to protect and deploy capital efficiently.

For Moody’s, this presented an opportunity to innovate and create something new and unseen in the marketplace.

By combining a legacy in proven, regulated, industry-leading cat modeling with the results and recommendations of the global scientific community on climate change, we can create climate-conditioned catastrophe models that provide a forward-looking view of risk.

Climate Risk Analysis: Best of Both Worlds

This approach brings together the best of both worlds, leaning into the strengths of each model class to create a highly robust and granular forward-looking view of climate impacts on real assets.

Ultimately, this is a hybrid approach that combines state-of-the-science techniques for event simulation and damage calculation, with state-of-the-science data from GCMs and the academic consensus on climate change, to produce robust estimates of near- and long-term acute physical risk.

To dig deeper on climate conditioned catastrophe modeling, read a blog from my colleague Claire Souch here.

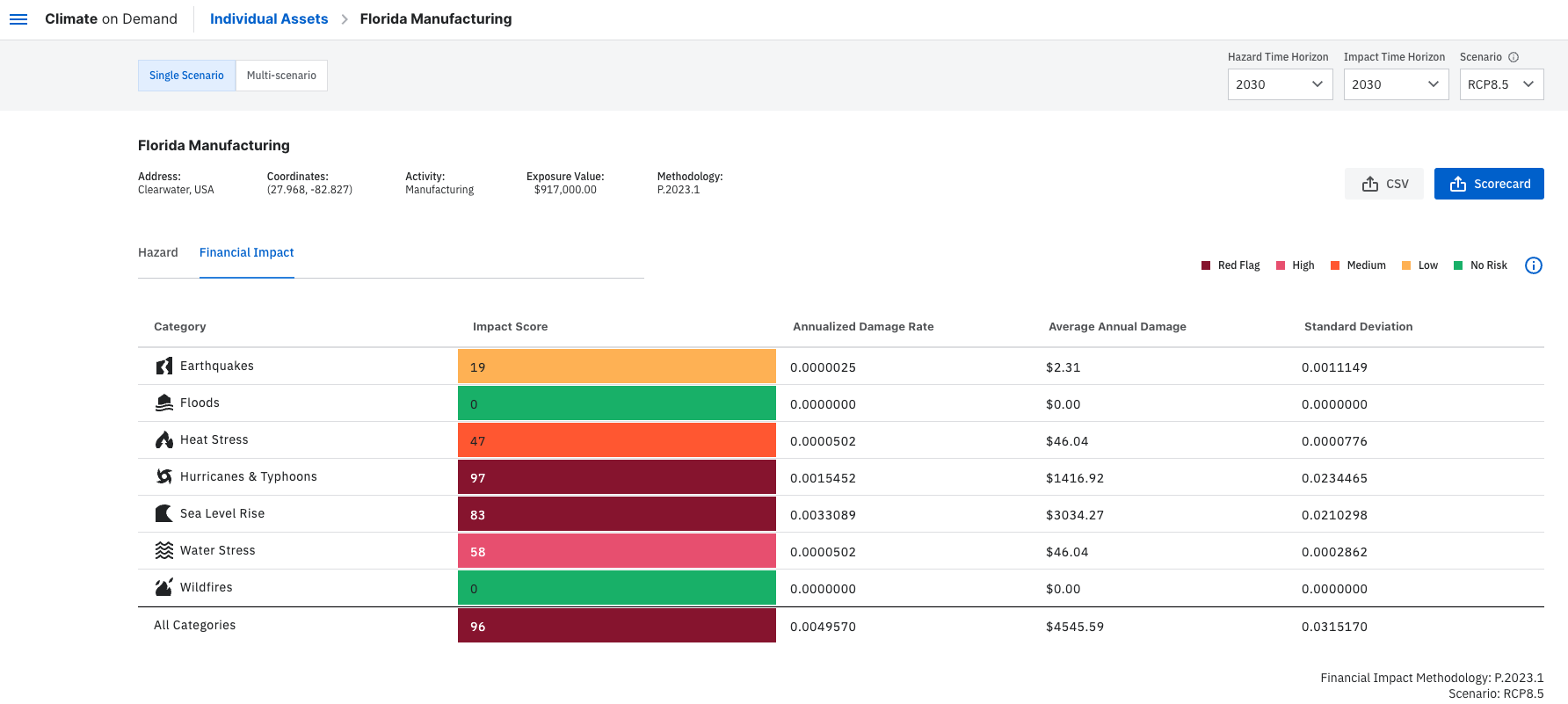

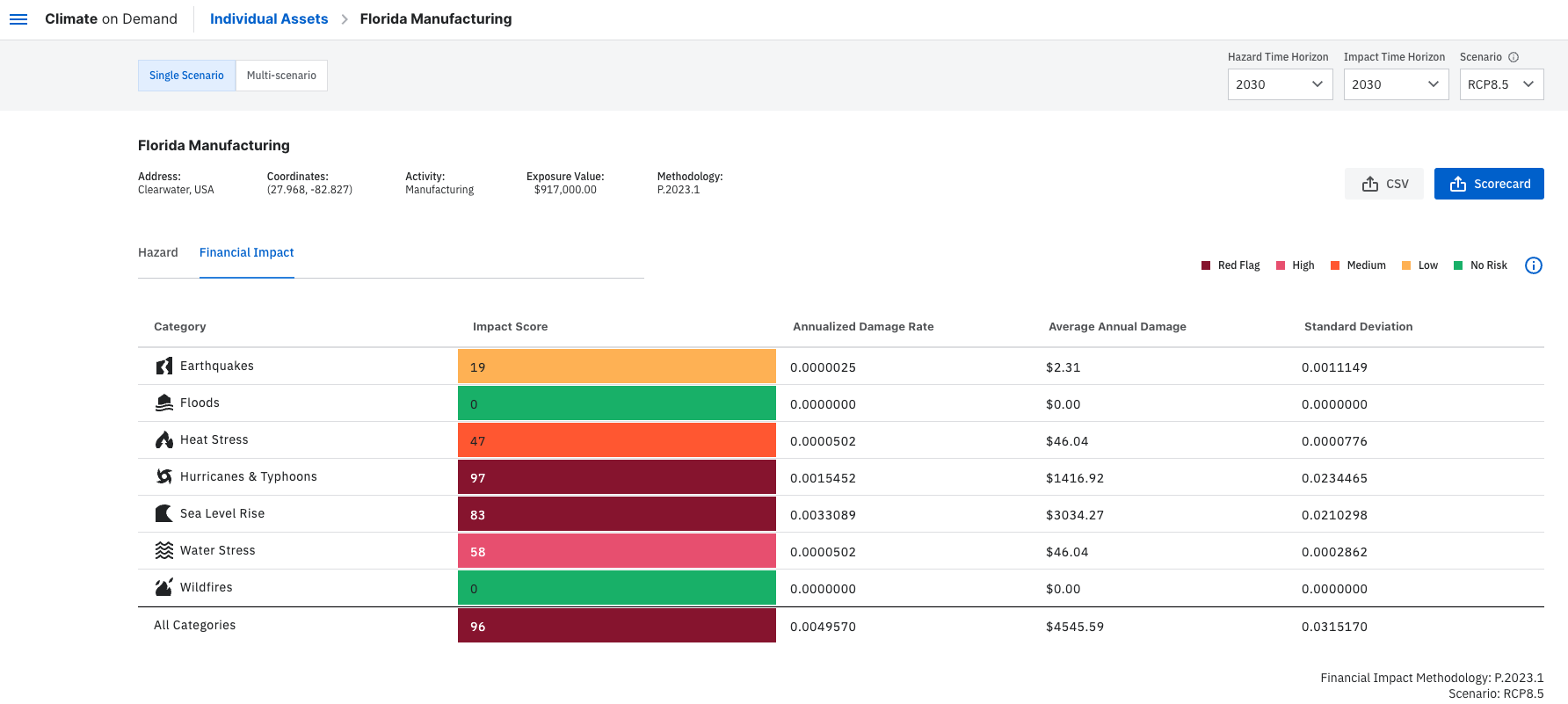

Evaluating an asset’s exposure to physical climate hazards is challenging, yet also an essential first step in managing climate risks. Moody’s Climate on Demand solution allows investors to assess their exposure to floods, sea level rise, hurricanes and typhoons, heat stress, wildfires, and water stress at the asset and portfolio levels.

Moody’s Climate on Demand also offers robust impact quantification and financial metrics aimed at providing investors with quantified potential damages at the property level. Armed with climate risk data at decision-relevant scales, asset owners can begin to manage their risk.

They can also leverage robust climate analytics to identify and quantify the potential damage from regional and sectoral trends as well as specific hotspots. Flexible viewing options and digestible data in the solution provide insight for portfolio risk assessments and due diligence processes, in addition to engaging stakeholders at varying climate risk fluency.

Tangible Assets Vulnerability to Physical Climate Risk

Real estate, infrastructure, agriculture, timber, and other tangible assets have long been an integral component of an asset owner’s portfolio due to their returns and the diversification they offer to the overall fund. However, many real assets are highly vulnerable to physical climate risks.

The use of climate data for portfolio management is needed as these risks manifest in direct and indirect ways, including increased costs, reduced revenues, and decreased asset value.

Asset owners are using Moody’s Climate on Demand to evaluate forward-looking physical climate risk exposure.

For example, the portfolio-specific summary table as shown below provides a snapshot of climate impact risks and serves as both an identification of risk drivers and a quantification of potential financial impacts.

In addition to earthquake risk, for this portfolio, heat stress, and, towards the end of the century, water stress are the most pressing hazards.

While asset owners frequently emphasize the hazards they view as most financially material — for instance, floods, hurricanes, and sea level rise; heat stress and water stress can also have material financial impacts.

Heat Stress and Water Stress

For instance, a major heat wave across Europe in the summer of 2019 demonstrated how increasing temperatures can cause business disruptions and raise operating costs.

Retrofits to help better address climate risks across real estate in Europe could result in a total increase in energy bills for commercial buildings of US$300 billion by 2050.

Water stress, another potentially overlooked risk, can threaten the long-term operations of assets that rely on large amounts of water, such as thermal power plants for cooling.

Moody’s has found that 11 major U.S. utilities representing over US$31 billion in rate base have extreme risk to water stress, which has already caused some power utilities to retire capital-intensive generation facilities early.

In addition to providing an entry point for further analysis, metrics in the summary table are useful for risk reporting.

As reporting requirements develop, outputs from Moody’s Climate on Demand will continue to empower asset owners to effectively capture asset exposure, communicate how their risks are being managed, and characterize the overall portfolio climate risk and resilience strategies.

Asset owners can also identify exposure hotspots, explore sectoral trends, and dive deeper into the exposure of individual assets.

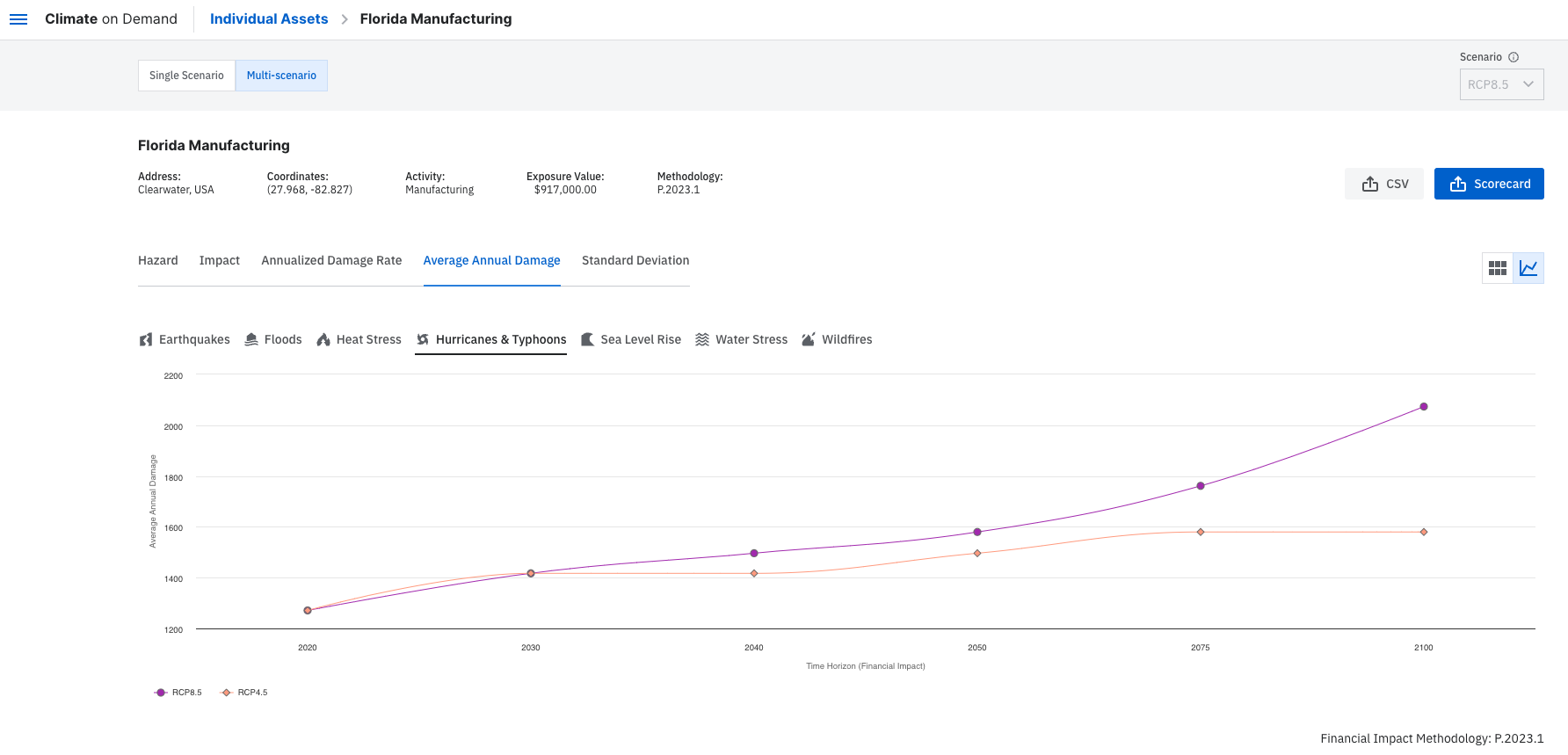

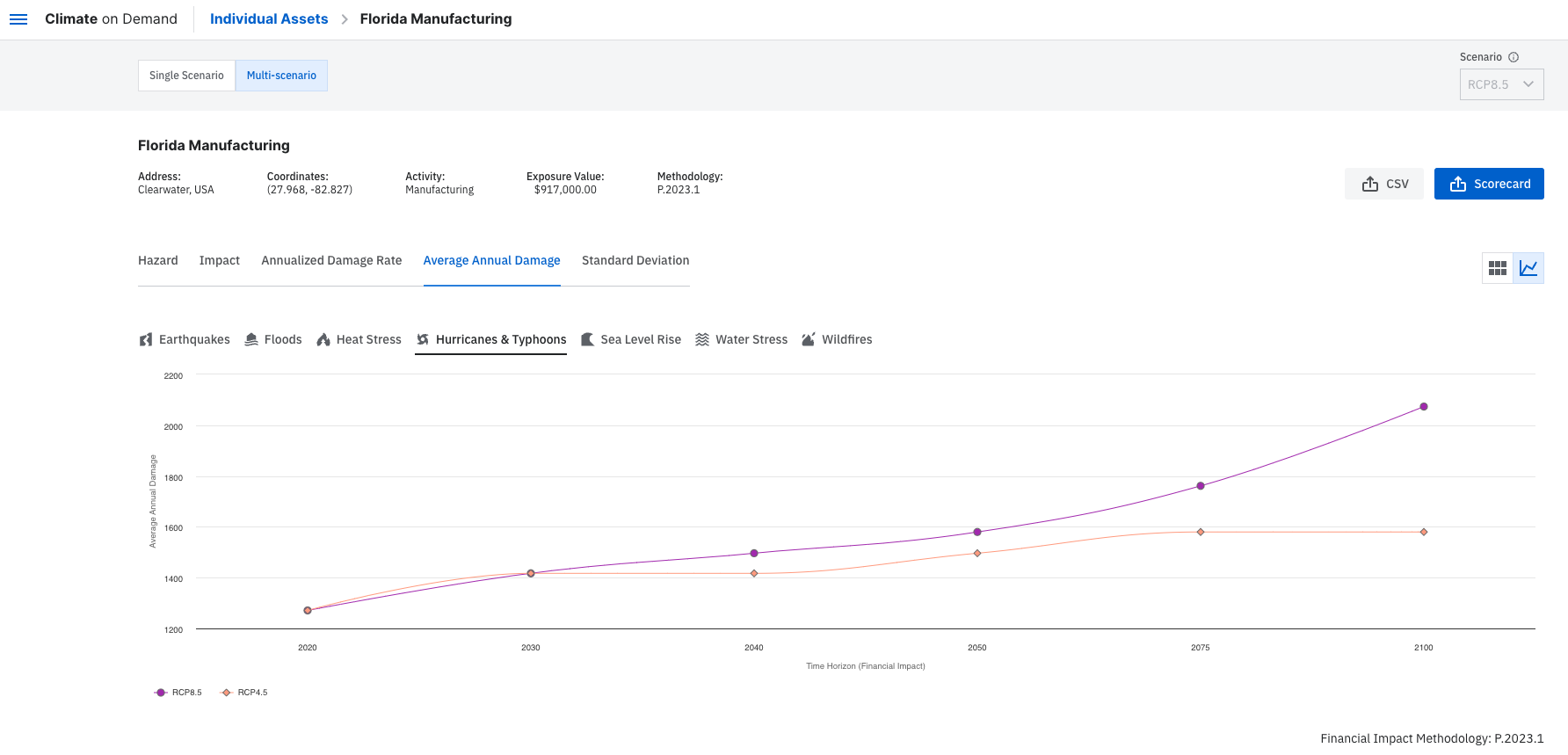

As we show in the figure below, a portfolio with high flood risk scores sees potential damage costs rise through to the end of the century across multiple Representative Concentration Pathway (RCP) scenarios. Ultimately, flood risk can raise costs, cause business disruption, and decrease asset values.

Through leveraging climate impact insights that span multiple RCPs with coverage to the end of the century, asset owners can consider shortening their holding periods for assets with the highest levels of exposure, ensure that they have appropriate insurance coverage, and evaluate if coverage or premium prices may rise in the future.

Monitoring the Evolving Climate Risk Landscape

As the climate changes, for insurers, risk tolerances may also reach their limits and they may seek to exit markets.

It is therefore essential for asset owners to monitor the evolving landscape. Beyond evaluating potential changes to insurance, asset owners can also use this data as an entry point for engagement with a property manager, to better understand a site’s flood history and to investigate if an asset has flood defenses.

Notably, Climate on Demand impact scores and damage metrics already account for flood defenses and for the building/industry type.

Institutional investors understand that over a typical commercial real estate hold period of seven to ten years, the next buyer of their property is likely to be concerned by climate risk as well.

The application equips asset owners with the exposure data they need to make sure their portfolios are resilient to climate risks and continue to provide the returns they need and expect from the asset class.

Beyond analyzing portfolios of existing holdings, the application’s real-time scoring allows asset owners to quickly incorporate physical climate analysis into their due diligence processes for new acquisitions.

In addition to providing easily digestible, high-level screening results, granular climate data allows clients to continue to invest, for example, into valuable coastal markets with known exposure.

Rather than exiting profitable markets, asset owners can use Climate on Demand to selectively invest in assets with lower exposure and expected damage over time.

To learn more about Moody’s Climate on Demand and the newly launched Pro Edition, talk to an expert today about incorporating climate risk in portfolio management and due diligence screening.