RESEARCH & INSIGHTS

Curated research & insights on critical dimensions of climate risk

Risks heighten for carbon-intensive industries as big banks’ focus on climate grows

Companies in hard-to-abate sectors are slowly raising the ambition of their decarbonization goals. Some could find it harder to attract funding as banks steadily clamp down on emissions financing.

Risks heighten for carbon-intensive industries as big banks’ focus on climate grows

Companies in hard-to-abate sectors are slowly raising the ambition of their decarbonization goals. Some could find it harder to attract funding as banks steadily clamp down on emissions financing.

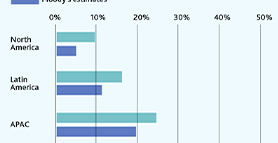

Innovation and risk-sharing support efforts to close wide climate finance gap

Bridging the gap will involve a multipronged approach to ensure infrastructure projects are attractive to private-sector investment and use of multilateral development bank funding is optimized.

Environmental reporting increasing alongside focus on emissions reduction

Many utilities and oil and gas companies in the Gulf Cooperation Council have set emissions targets, but none for indirect emissions in the value chain (scope 3), which form most of their emissions.

Natural resources and technological readiness allay carbon transition risks for some sovereigns

While the shift to clean energy comes with credit risks, these can be mitigated by associated economic opportunities for those governments with the institutional capacity to capitalize on them.

Integrated oil companies face growing exposure to carbon transition risk

Despite diversified business models and healthy access to capital, continued capital spending on oil and gas production and insufficient non-hydrocarbon investments indicate sustained exposure to a rapid transition.

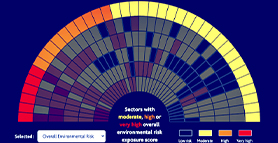

Trillions of dollars in global sectors’ debt highly exposed to environmental risks

A Moody’s Investors Service data interactive story delves into 90 sectors accounting for $82 trillion in debt in our rated universe, exploring the potential credit impacts from five major environmental pressures.

Evaluating the Performance of UK Flood Defences Under Climate Change

Flood defences play a vital role in protecting people and properties against flooding in the U.K. Moody’s RMS™ has conducted work in partnership with Flood Re to examine how climate change could impact flood defence outcomes.

MENA: Water-related risks broadly constrain credit strength, but exposure and mitigants vary

Exposure to water-related risks, which climate change will compound, curbs growth potential and erodes fiscal resources. It also adds to social and cross-border tensions, raising political risk.

Cities’ increased climate adaptation planning globally will support their long-term credit strength

Cities can be vulnerable to physical climate risks, such as flooding and extreme heat, given their geography and topography, and because of their concentrations of people, assets and infrastructure.

Sectors most exposed to rapid carbon transition are struggling to address risks

Positioning for a rapid transition to a low-carbon economy varies greatly among – and sometimes within – sectors, according to our newly updated proprietary carbon transition indicator scores.

Adapting to Hurricane Risk

Discover how Moody’s is helping insurers and real asset investors perform cost-benefit analyses on property-level hurricane adaptation investments, by modeling physical risks in the built environment and enabling stakeholders to measure the financial impact of hurricane risks now and in the future.

The Heat is On: Assessing Climate-Related Supply Chain Disruption for Critical Industries

How could future changes in climate and weather patterns increase these risks and their impact on communities and costs to businesses, including products vital to the global supply chain?

Carbon offsets can help mobilize transition financing but come with credit risks

Offsets can play a role in financing investments to achieve net-zero targets. But their use can also pose financial and reputational risks if not applied as part of a credible, science-based approach.

Test Your Risk Blind Spots with Seven ‘Less Familiar’ Potential Cat Events

Risk management professionals tend to focus on cat events from the last 10-20 years; take a look at seven less-familiar potential cat examples, which could all generate substantial insured losses, different perils across the globe, and notable impacts on portfolios.

Navigate climate risk with confidence – trusted data, financial insight, better decisions.